Tax-Compliant Invoice Calculator Online FREE | Calculate Invoice Total ...

Use our free Tax-Compliant Invoice Calculator to add items, apply correct tax rates, and automatically calculate tax amounts and total amounts. Perfect for businesses and freelancers …

Tax Inclusive vs Tax Exclusive: What’s the Difference?

Feb 10, 2025 · Learn the difference between tax inclusive vs tax exclusive pricing, how they impact your business, and which method works best for accurate tax calculations.

Choose how to show tax on your invoices – Xero Central

Use an invoice template to show tax amounts as included or excluded, and choose whether to display the tax rate applied. Show tax subtotals grouped by tax rates, individual components, …

Solved: sales tax amount calculation on purchase invoice

Nov 10, 2021 · There is a parameter that allows you specifying whether the amounts entered in the journal are net or gross. Seems that this parameter is different from what you expect. Note: …

What Should I Use For Inclusive Tax Computation - CaptainBiz

Jun 11, 2025 · Learn what to use for inclusive tax computation. Elevate your financial accuracy with our concise guide to informed decision-making.

How to Calculate Tax Included in an Invoice - HowtoExcel.net

Jun 15, 2021 · This is important if you need to determine how much in taxes you need to claim on an expense or how much you need to collect if you’re the seller. Below, I’ll go over a sample …

How to Calculating Invoice Total, VAT, Tax, and Discounts

This article is designed to guide you through multiple facets of invoice calculations - from calculating the total invoice amount, understanding VAT calculations, to figuring out discounts, …

Invoice with Tax Calculation – Excel Template for Billing

Send professional invoices with built-in tax calculations using this Excel template. Includes subtotal, tax %, and total fields—fully editable. Accurate billing is critical for professional …

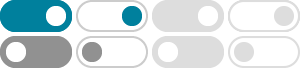

Tax Inclusive and Tax Exclusive Invoices - AutoEntry

Once a tax rate is selected, AutoEntry will recalculate the Net/Vat/Total amounts to reflect this. You can then use the drop-down menu above the Line Items table to select if the invoice is …

A guide to tax calculation methods in Cliniko | Cliniko Help

Choosing the right tax calculation method ensures your billing aligns with tax obligations and meets your practice’s needs. Cliniko offers two calculation methods: tax exclusive and tax …